Common objectives for trusts are to reduce the estate tax liability to protect property in your estate and to avoid probate. The trustee could make a distribution to either mom or dad whichever one of them is left alive and medicaid will not count the trust.

Invest In Trust Deeds

Invest In Trust Deeds

The power to make changes to the trusts.

[PDF] Free Download Trust Rules Book. The power to borrow from the trust without adequate security. Accordingly the trust is subject to the excise tax on its investment income under the rules that apply to taxable foundations rather than those that apply to tax exempt foundations. The power to add or change beneficiary of a trust.

A trust agreement is a document that spells out the rules that you want followed for property held in trust for your beneficiaries. For purposes of the organizational test when a charitable trust seeks exemption from tax as a charitable organization the trust is considered organized on the day it first becomes subject to section 4947a1. Mckinseys michael burchell expert organization solutions writes that trust rules provides succinct smart practical guidance on how to create a high trust high performing workplace.

The trust remains up and running after the death of its grantor and it can transfer its property to anyone the grantor has provided for in the trusts formation documents according to the grantors own terms. Rules for digitization of trusts records1 all the existing trusts records in all the offices under the control of the charity commissioner maharashtra state shall be converted into electronic record. The power to use income from the trust to pay life insurance premiums.

Assets held in a trust avoid probate because the trust itself doesnt die with its creatorcalled the grantor or trustmaker in legal terms. Every manager should read this book and refer to it often. Some of the grantor trust rules outlined by the irs are as follows.

When trust exists in an organization or in a relationship all aspects of the relationships involved become easier. Trust forms the foundation for effective communication employee retention employee motivation and contribution of discretionary energythe extra effort that people voluntarily invest in work. Trust rules provides succinct smart practical guidance on how to create a high trust high performing workplace.

Every manager should read this book and refer to it often. The rules above do not apply if either mom or dad set up a trust under his or her will and his or her assets flowed into that trust.

Ecommerce Trust Rules Three Islands Design

Ecommerce Trust Rules Three Islands Design

What Is A Testamentary Trust Grantor Created Rules For A

What Is A Testamentary Trust Grantor Created Rules For A

Diversifying Charitable Remainder Trust Investments Wealth

4 Simple Rules For Building Trust Between Teams

4 Simple Rules For Building Trust Between Teams

Understanding The Client Trust Account Rules Attorney

Understanding The Client Trust Account Rules Attorney

The New Partnership Audit Rules And Why They Are So

The New Partnership Audit Rules And Why They Are So

Pdf Shades Of Gray Applying The Benefit The Beneficiaries

Pdf Shades Of Gray Applying The Benefit The Beneficiaries

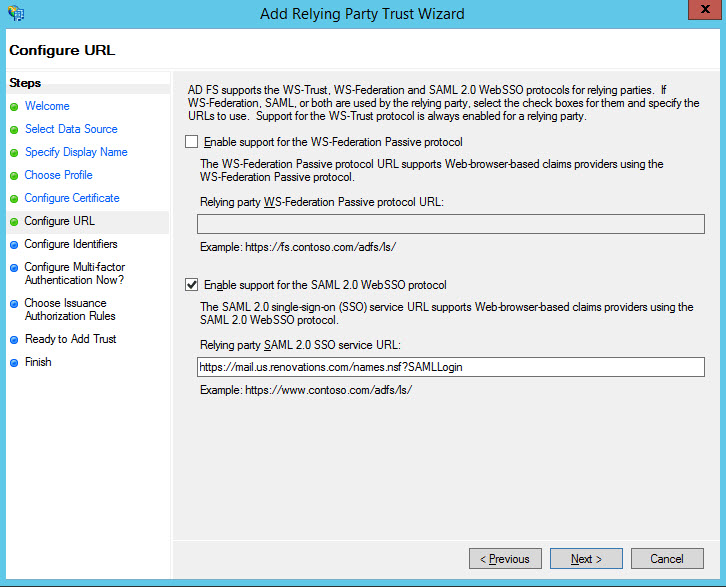

Setting Up A Relying Party Trust For Web Servers On Adfs 30

Setting Up A Relying Party Trust For Web Servers On Adfs 30

Picking A Trustee 4 Easy Steps Wealth Advisors Trust Company

Picking A Trustee 4 Easy Steps Wealth Advisors Trust Company

Configure Claim Rules For The Claims Provider Trust

Configure Claim Rules For The Claims Provider Trust

Using The Grantor Trust Rules To Shift Tax Responsibility To

Free Download Read Trust Rules Fullpages

Free Download Read Trust Rules Fullpages

Trust Tax Deductions New Rules You Need To Know Now

Trust Tax Deductions New Rules You Need To Know Now

Trust Rules Turkey Edition

Trust Rules Turkey Edition